How To Rent Atm To Make Money

Commercial real estate is typically a more lucrative investment than residential holding considering of the higher rate of render. Besides running your ain business concern or renting the space to some other business, yous can now consider some other option—renting it out to a bank for setting up an automated teller motorcar or ATM. According to the RBI, at that place is need for more ATMs in the country and to address this issue of fiscal inclusion, the apex bank has immune seven not-banking fiscal companies (NBFCs) to open white-characterization ATMs.

An ATM owned and operated by an NBFC is chosen a white-label ATM. While a majority of white-label ATMs are to be set upwardly in rural areas, a small percentage has to be installed in urban and semi-urban areas. For case, Vakarangee is mandated to prepare a minimum of 15,000 white-label ATMs in three years with a rural-to-urban ratio of 2:1. The Tata Communications Payment Solutions (TCPSL) will ready near v,000 of the mandated fifteen,000 ATMs in metros and urban markets.

When it comes to urban and semi-urban locations, there are basically ii ways in which you can apply your commercial infinite to earn additional income via the white-characterization ATM route.

Rent out the infinite

You can rent out your commercial infinite to a white-label ATM provider such as Prism Payment Solutions. Under its brand name, information technology deploys ATMs at locations with high footfall and good visibility beyond the country.

Another pick is to rent out a function of your commercial space while you continue to use it for your ain business concern. Accept BTI Payments Solutions' ATM-in-ashop concept. It allows for the ATM to be set up within the existing businesses bounds, such as retail bondage, shopping centres, businesses, standalone shops in urban locations, including Chennai, Hyderabad and Bengaluru. The rent you volition become from the NBFCs volition depend on factors similar the metropolis and the location of the ATM.

Franchise ATM

Another way for leveraging your commercial space is past taking an ATM franchise. This model has been launched by TCPSL, in collaboration with Franchise Bharat. "People tin invest money in an ATM franchise and earn a return on their investment," says Gaurav Marya, chairman, Franchise India.

If y'all have lobby space of 25 sq ft, or at least a l sq ft room, you tin take the franchise of Indicash TATA ATM. "The operation and repairs of Indicash are taken intendance of by united states of america," says Sanjeev Patel, CEO, TCPSL. The company will also deport the electricity charges and install the required electronic security equipment. Of course, the locations with the highest footfall will be most preferred.

What it costs

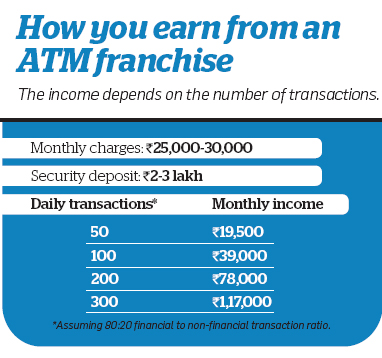

Though y'all will exist offering the infinite for the ATM to exist fix upwards, it will non exist installed for gratuitous. You will have to shell out a security deposit of Rs 2-3 lakh, depending on the infinite, location, and the number of ATMs you plan to install. Says Patel: "Since the ATM is owned by the visitor, you will have to pay a security deposit, which will be the equivalent of a few months' rent." In that location is also a fixed monthly charge that y'all will take to comport, and this will be in the range Rs 25,000-30,000.

Render on investment

A franchise will earn Rs fifteen for every cash withdrawal and Rs 5 for nonfinancial transactions. "The return on investment depends on the footfall that ane generates at the ATM. The return is calculated straight on the footing of the volume of transactions at a item ATM," says Patel. Ordinarily, an ATM starts making money when information technology clocks 100 transactions per day.

Hire, franchise and earnings

If you decide to hire out your commercial space, you could earn around Rs 25,000 per month from the NBFC that installs the teller machine.

If you decide to have a franchise, at that place will exist no rental income. But yous will have to deport all the costs mentioned before. However, if, over a menstruation of time, your ATM sees 200 transactions a day, of which, say, 160 are withdrawals and forty are not-financial transactions, you stand to earn a full of Rs 2,600. Fifty-fifty after deducting your costs, you could earn around Rs 53,000 (Rs 78,000—25,000) a month.

Hence, information technology all depends on the traction that your ATM receives, and this introduces an element of risk. And then, counterbalance your options before deciding on the route that suits yous.

Source: https://economictimes.indiatimes.com/wealth/real-estate/have-commercial-space-invest-in-an-atm-to-generate-income/articleshow/45157158.cms

Posted by: barkercamigat.blogspot.com

0 Response to "How To Rent Atm To Make Money"

Post a Comment